Trade in the UK - A Pre and Post-Brexit Comparison:

Pre-Brexit:

The Brexit vote took place on June 23rd, 2016. The actual leaving of the EU took place on January 31st, 2020. This was 1317 days where all you heard about was Brexit. So, I don’t think everyone has heard enough about it so I’m going to break it down some more.

Although the formal date was January 31st, 2020, trade terms between the UK and EU hadn’t been finalized. The UK didn’t have a trade agreement with the EU. The Trade and Cooperation Agreement between the two was signed on 30th December 2020.

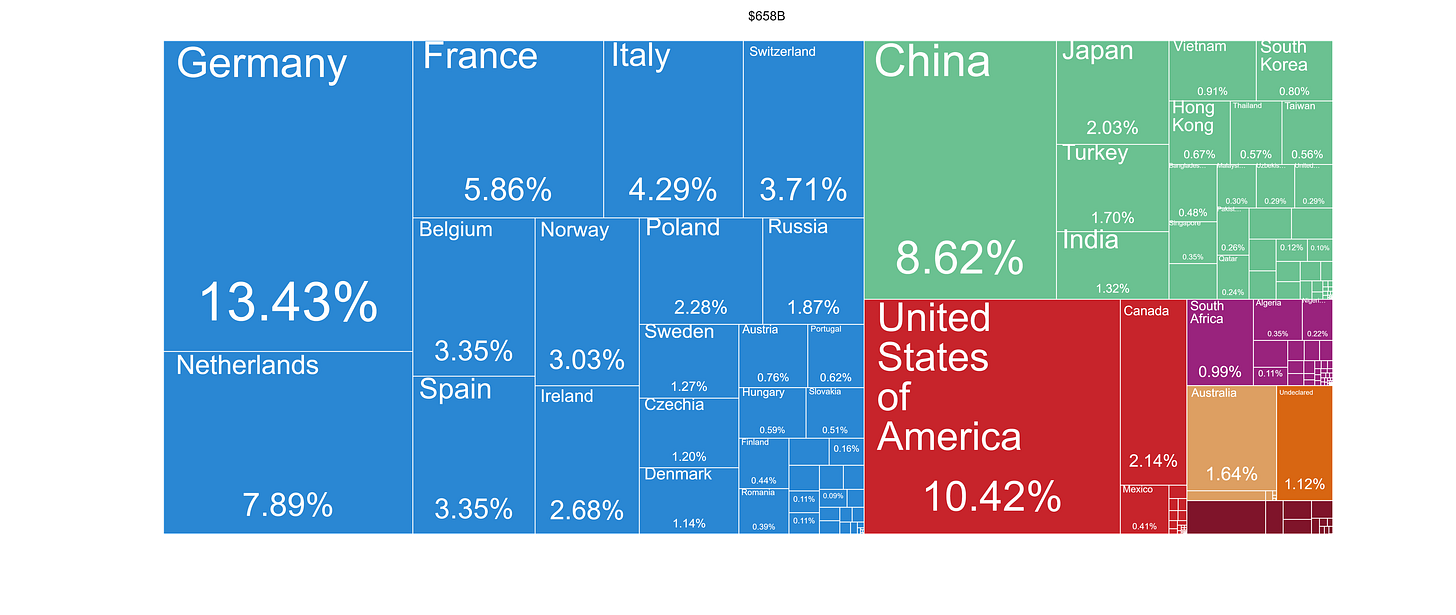

UK Imports (2019):

In 2019, the UK's biggest places to buy from were Germany, the US, and China. The Netherlands and France rounded out the top 5.

UK Exports (2019):

The UK exports the biggest percentage of its goods and services to the US (15.43% in 2019). Behind the US sits Germany, France, and The Netherlands. The importance of the EU members close to the UK is undebatable.

Of course, the UK leaving the EU doesn’t completely isolate them from trading with any EU members, but it is trending in a direction of reduced trade between the two parties. The UK have a trade surplus with non-EU countries, which dropped in 2021. The UK had massive budget deficits with the EU in 2019. The trade deficit the UK has with the EU still exists but is smaller and trending upwards. This demonstrates the UK is giving less money to the EU, and more money to non-EU members.

The table shows the change between the UK and EU trade. The trend away from the EU and the greater importance of trade in non-EU countries is clear.

The UK would have to pivot towards other trade partners further away. If they could have foreseen global supply chain issues brought on by COVID and the end of globalization, they might have been able to better prepare for the difficulty of accessing new trade partners.

Post-Brexit:

Where does the UK turn to in its new age of global trade? One key relationship for the UK is one with the US. The UK and Canada also maintain a strong link, with Canada as a member of the Commonwealth. Another member of the Commonwealth, and joint member in AUKUS, Australia could be another key player in UK trade, as well as New Zealand. But, all these countries are far away. Any trade from the US or Canada has to navigate the Atlantic, in which there are few barriers other than access to shipping and the time it takes to arrive. Trade from Australia and New Zealand would have to travel most of the world. This makes none of these countries the easiest options.

UK Imports (2020):

Even in the year of Brexit, Germany remained the biggest place from which the UK imports. The percentage of imports from China rose from 8.62% in 2019 to 12.21% in 2020. China manufactures a lot of things. When they joined the World Trade Organisation, a lot of manufacturing pivoted to them due to cheap labour. Many nations are now dependent on China for supply. Will we start to see this import percentage decrease? Imports from the US actually decreased between 2019 and 2020.

Most of the UK’s big trading partners remain close to home. This emphasises the importance of shorter-distance supply chains for trade (localization or glocalization). If this becomes the norm, imports from Germany, The Netherlands and France could remain high.

UK Exports (2020):

The UK still maintains strong export relationships with the EU countries. Ireland’s relationship with the UK grew, likely due to COVID supply chain issues leading to accessibility issues. Exports to the US also decreased in 2020, likely due to COVID. Seeing this downtrend reverse and an increased trade relationship between the US and UK is likely.

The UK is the 6th biggest economy in the world (recently overtaken by India), and if I ever need to buy anything I can get it, currently. But we don’t think short-term, we prepare for the long-term. So what will UK trade look like in 10 years or even 20 years? Who will be the biggest trade partners?

Well if the world is trending towards smaller supply chains, I’d predict that trade with Germany, The Netherlands and France would remain high. Larger trade with Scandinavia for energy could also be expected. In 2020, Norway overtook France as the biggest energy exporter to Europe. With pivots away from Russian energy, whether by choice or sabotage, the UK will find energy sources that are close to home. This will lead Scandinavia to source its own through renewables, nuclear, and shale exploration. This comes after the ban on fracking was reversed under new prime minister Liz Truss.

I expect stronger relationships with the US, Canada, Australia, and New Zealand. All are close allies with similar ideologies on how to run a country. Although the long distance, New Zealand is self-sufficient when it comes to food (milk, meat, fruit, and vegetables). It also remains out of most geopolitical tensions. They would be a strong trade partner to have. The US are the biggest economy in the world and has the world’s reserve currency. Being a partner with a country that controls security for most global supply chains is important. Yet, as we are seeing currently, a strong dollar isn’t always a good thing, and other currencies suffer, including the pound. Check the $DXY currently. This is the clear trend of current dollar strength leading to other currency weaknesses.

The trend for the UK appears to be one further behind the large shadow of the US. Even if the US turns away from the global order and fends more for itself, the UK will remain one of its most trusted allies. The UK will remain a large country in Geopolitics, as its global reach is undeniable. But they will be stood one step behind the US, or a few more steps depending on who sits in Downing Street.

Credit to:

The Growth Lab at Harvard University. The Atlas of Economic Complexity.

http://www.atlas.cid.harvard.edu

Statista

European Commission

UK Parliament, House of Commons Library