Contents

Introduction

The History of Tariffs

Concluding Remarks

News In Geopolitics This Week

Bitesize Edition

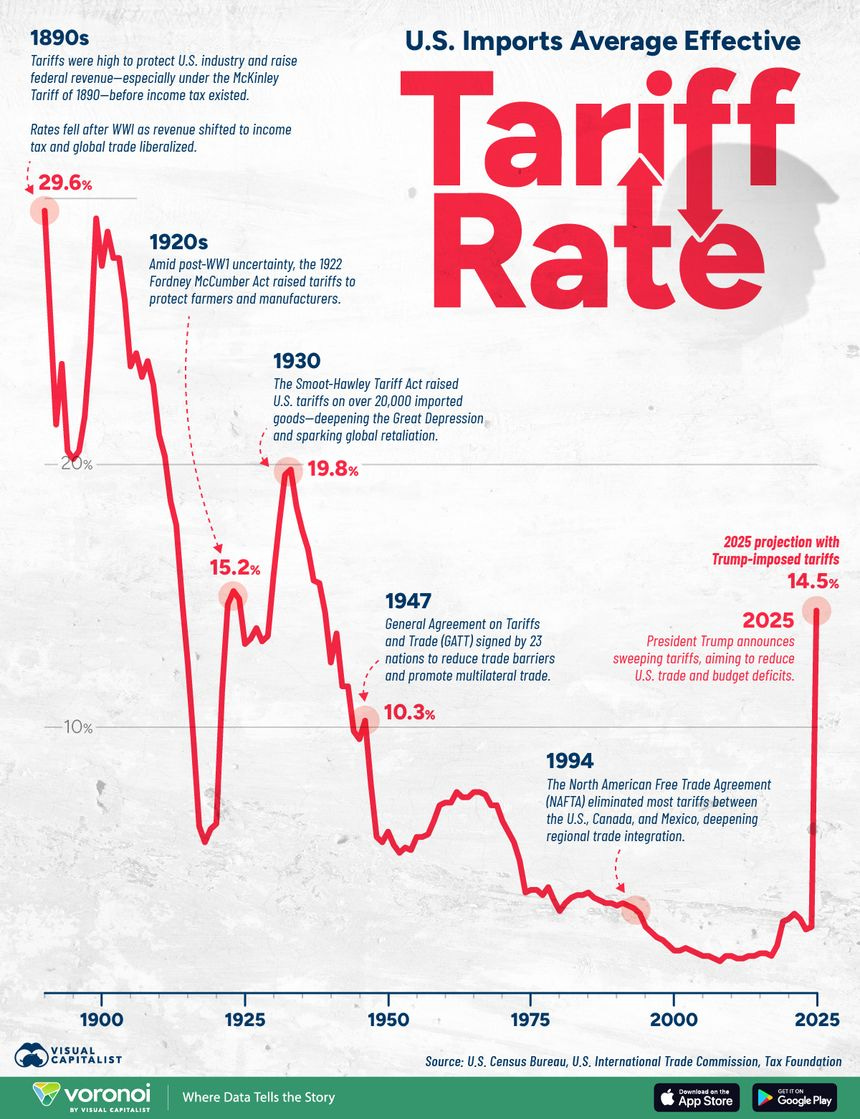

When considering the impact of Trump’s Liberation Day tariffs (if they return), we have many similar examples from history that we can explore. The Tariff of Abominations divided the North and South and contributed to the downward spiral that led to the Civil War. McKinley’s tariffs were a huge inspiration for Trump’s tariffs, but McKinley expressed interest in pursuing a more open trade policy the day before he died. The Smoot-Hawley Tariff worsened and prolonged the Great Depression.

These examples don’t paint a pretty picture of the potential impact of tariffs. Hence, it’s prudent to explore why tariffs keep coming back, despite their troubled past, and to dive into greater context of the tariff periods of the past.

Introduction

Anybody who has read my first few posts on the Trump tariffs will likely have the impression that I’m sceptical about their potential success. Today, I’m going to dive into previous examples of periods where tariffs were raised. On Thursday, I’ll then explore the effects of these tariffs and whether similar effects will be seen if the Liberation Day tariffs return.

The History of Tariffs

Many times in the history of the United States, tariffs have been implemented as a trade tool. Which of these times had the biggest impact?

Tariff of Abominations - Back in 1828, the rising manufacturing areas in the north of the United States wanted to protect themselves from cheap British imports. On the flip side, the Southern states were heavily reliant on imports and cotton exports, and hence opposed tariffs. The overarching goal here was to protect U.S. manufacturing by taxing foreign goods via tariffs. President Adams feared that the tariffs would undermine him politically, especially in the South, which came true when he lost to Andrew Jackson in 1828, a South Carolina native. But Johnson kept the tariffs in place, hoping to put any revenue towards the national debt. By 1830, the effects of the tariffs were beginning to become visible. Most importantly, British imports of Southern cotton had fallen, which hurt the South. The Tariff Act of 1832 aimed to address some of the unhappiness in the South, but this wasn’t a successful strategy. South Carolina then threatened secession, calling the tariffs unconstitutional, and attempted to nullify, which led to a confrontation with the Andrew Jackson administration known as the Nullification Crisis. This eventually led to the Compromise Tariff of 1833, where rates were actually lowered to avoid a conflict. However, the “Black Tariff” of 1842 raised tariff rates to 40%. Tensions between North and South started here, and decades later, we saw the Civil War unfold.

Morrill Tariffs - In 1861, the Morrill Tariff was passed just before Lincoln’s presidency because the Southern states began seceding and opposed such protectionist policies. The aim here was to raise revenue for the federal government and protect industrialisation in the North. This ultimately helped to finance the Union war effort during the Civil War, but deepened the economic divides between the North and South.

McKinley Tariffs - In the 1890s, the United States was in an industrial boom period. Again, to protect U.S. manufacturers and promote job growth, a 50% tariff was placed on many imports, including sugar, wool, and tinplate. Higher prices on imported goods led to inflation, which contributed to Republican losses in the 1890 midterms and their loss of the Presidency in 1892. The Wilson-Gorman Tariff in 1894 reversed some of these hikes. Trump is a big fan of McKinley, stating that his tariff policy in the 1890s made the United States a lot of money. But this period saw the expansion of electricity availability, telecommunications advanced, and railroads continued to grow. Immigration was also increasing at this time, ensuring labour was cheaper. Today, does the United States have any of these advantages? Before his death, McKinley had recognised that the United States had a large manufacturing surplus, and he wanted to send this extra capacity to the rest of the world. He laid this out in September 1901 in a speech, but was shot the day after. We will never know how this would have panned out, but regardless of McKinley’s pivot, Trump continues to describe McKinley as a “tariff king”, largely because it suits his narrative.

Smoot-Hawley Tariff - The Great Depression had seen rising unemployment and collapsing farm prices. To protect these farmers from imports from abroad, Smoot and Hawley raised tariffs on over 20,000 imported goods. Average duty rates increased from 38% to close to 60%. A key difference from previous tariff occurrences was that this time, over 25 countries retaliated, including Canada, France, and Britain. Global trade fell by 60% from 1929 to 1934. This eventually led to the 1934 Reciprocal Trade Agreements Act (RTAA), but not before it deepened and prolonged the Great Depression.

Nixon’s Import Surcharge - In 1971, President Nixon ended the Bretton Woods system when he removed the peg between the U.S. dollar and gold. A temporary 10% import surcharge on most goods was enforced as US gold reserves fell and the trade deficit widened. The overarching aim here was to force other countries to revalue their currencies higher, since if the dollar was cheaper against other currencies in a floating exchange rate system, this would make U.S. exports cheaper. This led to the Smithsonian Agreement of 1971 and the rise of the floating exchange rate system that remains in place today.

Reagan’s Tariffs - Again, the U.S. trade deficit was soaring in the 1980s, and sectors known for U.S. manufacturing, such as steel and autos, were declining. At the same time, one of America’s worries was that Japan was rising as an economic powerhouse, and so the U.S. wanted to curb Japan’s dominance in electronics and autos. Voluntary Export Restraints and limited car exports from Japan occurred, and a 45% tariff was placed on large Japanese motorcycles in an effort to aid Harley-Davidson. Interestingly, in the present day, during negotiations between India and the United States, the Indians offered to ease tariffs on Harley-Davidsons as a potential incentive for the Americans to formulate a deal. As is occurring today, the aim was to encourage Japan to build in the United States, just as Trump is attempting to replicate today. The free-market philosophy typically associated with the United States at this time led to criticism of Reagan’s tariffs, but in the long term, it led to more managed trade and the utilisation of bilateral trade agreements.

Bush’s Steel Tariffs - Again, in 2002, U.S. steel was in decline, and the industry needed restructuring. The industry was lobbying for protection as global overcapacity was rising and imports were becoming cheaper. Tariffs of between 8% and 30% were implemented, but the WTO ruled against them, calling them illegal. The EU and others threatened retaliation, and Bush lifted them in 2003. Although some steel jobs were saved in the short term, in the long term, higher costs emerged.

Trump Tariffs Part 1 - In his first term, Trump was concerned over trade imbalances, Chinese theft of U.S. intellectual property, and manufacturing decline. He wanted to revive declining industries and force China to reform its trade practices. Section 232 tariffs involved 25% steel tariffs and 10% on aluminium, both of which Trump has reimplemented in his second term. Section 301 tariffs involved four rounds of tariffs on over $360 B in Chinese imports. Washing machine and solar panel tariffs were also implemented. In response, China hit soybeans, pork, and other goods with retaliatory tariffs. This escalating trade war especially hit U.S. farmers and consumers. In an effort to de-escalate, China promised to buy more U.S. goods, but it didn’t meet the targets. As for the effect on U.S. businesses and consumers, we saw costs rise. In reducing the trade deficit, there was little effect.

In considering these examples throughout history, what were the overarching threads that were consistent amongst these tariff occurrences? On what occasions did we see inflation rise? Has the aim of addressing the trade deficit via tariffs ever been successful, even for a short time? And finally, has anybody ever actually achieved what they set out to with their tariff policy? I'll discuss this on Thursday.

Concluding Remarks

As we can see, there are many examples of tariffs throughout history from which we can learn some lessons. Next time, I’ll dive into some of these lessons, specifically through the scopes of inflation, the trade deficit, manufacturing, and the labour market. How were these characteristics affected by the tariffs of the past, and how will they be affected by Trump’s tariffs today, especially if the Liberation Day tariffs return? Subscribe if this post on Thursday takes your interest and it will be sent straight to your email inbox.

News In Geopolitics This Week:

Africa

Asia

Japan’s Finance Minister Threatens Liquidation of US Treasuries

Pakistan Defence Chief Warns Military Incursion By India Is Imminent

Europe

Middle East

Gaza Ceasefire Talks In Cairo Close To “Significant Breakthrough”

Netanyahu Vows Response After Houthi Airport Strike, Citing Iranian Involvement

Netanyahu’s Wife Caught Saying Less Than 24 Hostages Left Alive In Gaza

Pope Francis’ Popemobile Transformed Into Gaza Mobile Clinic

Turkish Jets Engaged In Electronic Jamming Operations Against Israel

North America

FDA Approves First Cell-Based Gene Therapy For Rare Skin Disorder

Stephen Miller Emerges As Trump’s Next Potential National Security Advisor

Tariff Front-Running Sends Trade Deficit To New Record High In March

Trump Admin Revokes 4000 Student Visas Linked to Criminal Records

Trump Demands Egypt Give Free Passage Through Suez and Support Against The Houthis

U.S. House Passes Resolution to Stop California Banning Gas-Powered Cars

Oceania

South America

Other

Thanks for reading! I’d greatly appreciate it if you were to like or share this post with others! If you want more then subscribe on Substack for these posts directly to your email inbox. I research history, geopolitics, and financial markets to understand the world and the people around us. If any of my work helps you be more prepared and ease your mind, that’s great. If you like what you read please share with others. Remember, this post is up to date as of the day it was released.

Key Links

The Geopolitics Explained Podcast

If you want to see daily updates and discover other newsletters that suit you, download the Substack App.

You can become a paid subscriber to support my work. There are paid posts every Thursday and long-form monthly articles in my global questions series exclusively for paid subscribers. The Geopolitics Database is also accessible. Read Geopolitics Explained for 20p per day or start a free trial below to find out if my work is for you! I appreciate your support!

Sources:

https://www.adamsmith.org/blog/the-tariff-of-abominations

https://www.britannica.com/video/Tariff-of-1828/-284084

https://edition.cnn.com/2025/02/12/business/trump-william-mckinley-tariffs/index.html

https://kevinbryanecon.com/o3McKinley.pdf

https://www.nytimes.com/1971/12/21/archives/import-surtax-ended-by-nixon-he-signs-proclamation-on-flight-to.html

https://www.piie.com/commentary/op-eds/2017/trump-plays-reagans-game-tariffs-and-taxes

https://www.newsweek.com/china-uses-ronald-reagans-1987-speech-criticize-trumps-tariffs-2056562

https://www.tandfonline.com/doi/full/10.1080/14747731.2019.1700746

https://www.standard.co.uk/hp/front/bush-backs-down-on-steel-6942791.html

https://www.morningstar.com/economy/tariffs-will-reduce-us-gdp-are-unlikely-reduce-trade-deficit

https://www.investopedia.com/ask/answers/010715/what-difference-between-current-account-deficit-and-trade-deficit.asp

https://www.piie.com/blogs/realtime-economics/2025/why-higher-tariffs-wont-shrink-trade-deficit

https://www.nbcnews.com/data-graphics/trump-tariffs-manufacturing-us-business-jobs-economy-rcna199721

https://theconversation.com/trump-thinks-tariffs-can-bring-back-the-glory-days-of-us-manufacturing-heres-why-hes-wrong-253991

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

https://www.forbes.com/sites/jackkelly/2024/11/08/trump-tariffs-impact-on-american-jobs/

https://www.axios.com/2025/04/15/trump-tariffs-jobs-goldman-sachs