Game Theory: The Mathematics of Game Theory – Part 3

Managing Risk and Staying In The Game.

Risk of ruin describes the probability that an individual will lose such amounts of money that they reach the point where recovering the losses is impossible or they don’t have sufficient capital to continue what they were doing, be it trading, investing, or gambling. The risk of ruin is typically calculated using value-at-risk.

Value of Risk Calculation:

Value at risk (VaR) is a statistic that places the possible financial losses into a numerical value, for a specific time frame, with a certain probability of confidence. Basel ׀ in 1988 was designed to control credit risk. And Basel ׀׀ in 1996 allowed banks to use VaR models to do this. There are three different methods through which it can be calculated:

1) Historical VaR

2) Variance-Covariance VaR

3) Monte-Carlo VaR

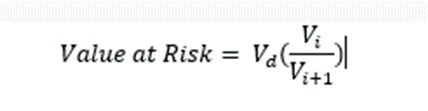

The Historical VaR is the simplest with the formula:

D is the number of days in the period, and V is the number of variables on a day i. A common period of 252 days is used as this is the number of trading days in a year. VaR is useful when comparing different assets, but there is no standard approach for using the formula. So the underlying processes that lead to a VaR result could be flawed. For example, if a period of 20 days is chosen where there was very little market activity, the lower volatility could make the financial losses appear less than reality. The examples get complicated mathematically and include distributions and probabilities. I’ll include all the complex maths in the appendix.

Value At Risk vs Standard Deviation:

In investment, value at risk shows the potential loss that an asset could experience over a period of time. The standard deviation shows how much the returns of an asset can vary over time. So standard deviation measures volatility. A higher standard deviation means an asset is more volatile and hence riskier.

Keep reading with a 7-day free trial

Subscribe to Geopolitics Explained to keep reading this post and get 7 days of free access to the full post archives.