Contents

Introduction

What Is Net Present Value?

Example Calculation

Assessing NPV And Its Usefulness

Concluding Remarks

Bitesize Edition

Net Present Value (NPV) measures the value of all future cash flows for a project or investment. These cash flows are discounted to the future to account for the time value of money.

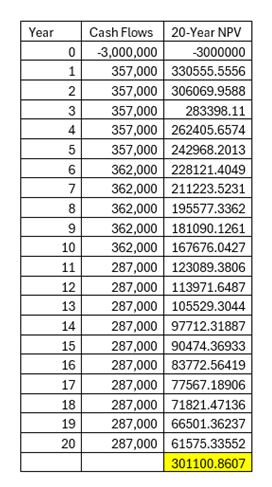

In an example provided by research from Johnson and Solomon, we’ll explore the NPV for a wind turbine project.

As I discussed last week regarding LCOE, there are many assumptions that have to be made with these calculations. Inaccurate assumptions therefore can heavily influence the final metric and any conclusions we draw from it.

However, if we take a worst-case scenario in calculating these metrics, can we assess which of these energy projects are best equipped to navigate volatile conditions? Let’s explore below.

Introduction

As I continue to explore affordability metrics in electricity generation, I’m hoping to find some metrics that we can rely on. In exploring the levelized cost of energy, I concluded the assumptions required could lead to misleading figures, and the period of low interest rates made some projects appear cheaper than they would be, especially now we exist in an environment where this isn’t the case.

In hoping for a stronger metric, I move on to net present value.

What Is Net Present Value?

Net Present Value - The value of all future cash flows over the life of an investment, discounted to the present.

Quite a lot to break down here. Let’s take it section by section.

Cash flows are the money that is coming in and out. So, it is how much cash a company or project has coming in or going out as a result of its activities.

The discounting refers to the time value of money. Because of inflation, £1 today is worth less than £1 was last year. In floating rate currencies, inflation is the trade-off for central banks, which have greater flexibility in monetary policy and money supply. Discounting also accounts for different levels of risk in different projects.

By using NPV, we can look at a project, and assess if initial costs will be worth it years down the line. When considering the lifetime of electrical infrastructure, this could be a useful exercise.

Now that we’ve determined that we can look at the money coming in and out of an energy project and assess its potential financial success or failure, all while accounting for the time value of money, I’m feeling optimistic about this metric. Let’s look at an example.

Example Calculation

Taking help from research by Johnson and Solomon, I’ve created the following cost outflows for a wind turbine:

Year 0:

Turbine Cost = $2,000,000

Transportation = $200,000

Construction = $800,000

Years 1-5

Research Project = $5,000

Years 1-30 (Ongoing Costs)

Maintenance Cost = $50,000

Insurance Costs = $3,000

Operation Costs = $50,000

Now to assess the inflows:

Years 1-10

Production Tax Credit = $75,000

Years 1-30

Electricity Generation = $300,000

Renewable Energy Credit = $90,000

The equation for NPV is as follows:

Hence, the calculation will be as follows:

This project has a positive NPV, so this is a project potentially worth pursuing. Now, we have to dive into the underlying assumptions of such a calculation.

Assessing NPV And Its Usefulness

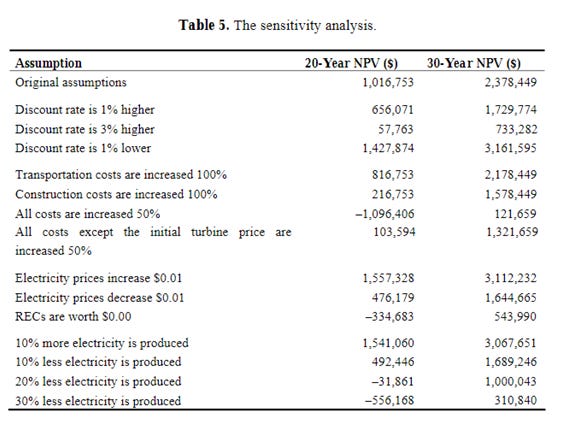

Once again, based on the research from Johnson and Solomon, and their own example, we see NPV is dependent on the discount rate.

We also have many assumptions associated with the cost inflows and outflows of the projects in the research example.

The following assumptions are made by Johnson and Solomon:

Electricity Cost is $0.06/kWh

Transportation Costs Are Uncertain

Construction and Insurance Costs From The JEDI Model

Lifespan of 30 Years

Subsidies and Tax Credit Support

Again, many assumptions are involved in this metric, as with the levelized cost of energy. Perhaps I got my hopes up too quickly. Alas, there is one saving grace. If I take the worst-case scenario imaginable, with a shorter lifespan, higher costs, and low electricity selling prices, and a project still has a positive NPV, it could be a project that can navigate tough times and hence would be a project that could thrive in good times.

If we compare NPV and LCOE, we can see the same assumptions being made. Hence, if we’re to gain some positive value from these metrics, perhaps we need to adopt a sensitivity analysis approach.

If we make the best of every scenario and don’t consider our environments and what energy generation methods are best suited to them, then we’ll receive a more favourable NPV or LCOE. But best-case scenarios aren’t the norm, and so these results could be misleading. If we take the worst-case scenario and still have a positive NPV and low LCOE, that could be a project worth pursuing in the individual environment that is being considered.

There are differences, of course. NPV can assess if a project will generate more value than it costs. In nations like the UK, which is currently attempting to pursue profitable energy projects to improve productivity, this will be a valuable metric in determining which projects they should prioritize.

As for LCOE, once a project is operational, it represents the average cost per unit of electricity generated. If we have a collection of positive NPV projects, we could then look to LCOE to compare their cost-effectiveness.

These metrics have their uses, but they must be applied to specific situations. Otherwise, they can be misleading. It would also be beneficial to apply a sensitivity analysis approach to consider the worst-case scenario. That way, projects that still look promising could be ones worth pursuing, as these will be better equipped to navigate a range of scenarios thrown at them.

One such area of energy generation where I believe it’s prudent to explore NPV further is the nuclear industry.

Concluding Remarks

Next week, I’ll explore the nuclear industries in France and China, and what their NPV and LCOE can tell us about them. France developed their nuclear industry decades ago, and China is undergoing development right now. There will be lots to compare so come back next week for that!

Thanks for reading! I’d greatly appreciate it if you were to like or share this post with others! If you want more then subscribe on Substack for these posts directly to your email inbox. I research history, geopolitics, and financial markets to understand the world and the people around us. If any of my work helps you be more prepared and ease your mind, that’s great. If you like what you read please share with others.

Key Links

The Geopolitics Explained Podcast

If you want to see daily updates and discover other newsletters that suit you, download the Substack App.

You can become a paid subscriber to support my work. There are long-form monthly articles in my global questions series exclusively for paid subscribers. Read Geopolitics Explained for 20p per day or start a free trial below to find out if my work is for you! I appreciate your support!

Sources:

https://www.investopedia.com/terms/n/npv.asp

https://corporatefinanceinstitute.com/resources/valuation/net-present-value-npv/

https://hbr.org/2014/11/a-refresher-on-net-present-value

https://www.highradius.com/resources/Blog/cash-flow-from-investing-activities/

https://www.investopedia.com/terms/c/cashflowstatement.asp#:~:text=A%20cash%20flow%20statement%20is%20a%20financial%20statement%20that%20provides,investments%20during%20a%20given%20period.

https://www.investopedia.com/terms/i/inflation.asp

https://www.researchgate.net/publication/45267850_A_Net-Present_Value_Analysis_for_a_Wind_Turbine_Purchase_at_a_Small_US_College

https://corporatefinanceinstitute.com/resources/valuation/levelized-cost-of-energy-lcoe/#:~:text=The%20LCOE%20can%20be%20used%20to%20determine%20whether%20to%20move,Electricity%20Generated%20Over%20the%20Lifetime).

https://world-nuclear.org/information-library/country-profiles/countries-a-f/france#:~:text=France%20derives%20about%2070%25%20of,generation%20to%2050%25%20by%202025.

https://www.reuters.com/business/energy/frances-edf-logs-20-surge-first-half-profit-warns-about-price-declines-2024-07-26/#:~:text=It%20is%20in%20talks%20over,its%20first%2Dhalf%20earnings%20presentation.

https://montelnews.com/news/718d5f7b-5144-4bc6-aceb-2d51776fc38e/financing-issues-may-curb-french-nuclear-revival-experts

https://www.sciencedirect.com/science/article/pii/S0301421510003526

https://www.sciencedirect.com/science/article/pii/S0301421513011440

https://medium.com/geekculture/what-is-negative-learning-and-how-to-avoid-it-452d9e4c8263

https://apnews.com/article/georgia-nuclear-power-plant-vogtle-rates-costs-75c7a413cda3935dd551be9115e88a64

https://thebreakthrough.org/issues/energy/chinas-impressive-rate-of-nuclear-construction

https://x.com/Atomicrod/status/1528689000533352450

https://inis.iaea.org/collection/NCLCollectionStore/_Public/52/022/52022206.pdf

https://www.powermag.com/china-starts-construction-of-more-reactors-as-part-of-rapid-nuclear-buildout/

https://www.eia.gov/todayinenergy/detail.php?id=61927

https://www.sciencedirect.com/science/article/abs/pii/S0301421513011440

https://www.nrel.gov/analysis/jedi/