Contents

Introduction

NPV and Scalability

France, Nuclear NPV, and Scaling Down To Scale Up

China and Nuclear Power: Scaling Up To Scale Up

Concluding Remarks

Bitesize Edition

Two countries that have undergone, or are currently undergoing, large developments within the nuclear industry, are France and China.

Unfortunately, long build times and rising costs have seen many examples of nuclear projects possessing a negative net present value, such as units 3 and 4 of Vogtle in Georgia, USA. Hence, I decided to explore France’s nuclear buildout of the past, and if when they built out, their projects possessed a positive or negative NPV. I’ll then look towards China, which is experimenting with a range of nuclear power plant designs, including a thorium-fuelled molten salt reactor in the Gobi Desert. This reactor produces 2MW of thermal power and no electricity, but it will teach the Chinese a lot about innovating nuclear power. It interests me that if China is constructing nuclear plants that have a positive NPV, how is there such a void between Western-developed nuclear power plants?

We need baseload power, while also cleaning up our planet, and not resorting to other baseload sources such as coal. In a sentence, we need nuclear. How can the NPV indicate the difficulties some nations are facing in their construction of nuclear power plants, and what can they learn from projects that have a positive NPV?

Introduction

Last week, when exploring an example of a wind turbine, we saw a positive net present value. As a reminder, net present value (NPV) is the value of all future cash flows over the life of an investment, discounted to the present.

In isolation, if we see a positive NPV, that would imply a project worth pursuing. There are, however, many more tests and metrics that our electricity generation methods should have to pass. One such important test is our personal environment. As I discussed when exploring the capacity factor of such methods, low efficiencies in the UK for solar make it less suited to the UK environment. Investment can be used more productively if we consider the individual environment in which construction is occurring.

The key takeaway from last week was to utilize NPV, and other affordability metrics, as sensitivity analysis methods. This means considering these generation methods in a worst-case scenario. Assume high debt financing costs, and shorter lifetimes for the generation methods so the costs are spread over a shorter time. We can also assume electricity is sold for cheaper, and less electricity is produced. If a method still shows a positive NPV after all this doom and gloom, it’s very likely a promising generation method within the specific environment being considered.

With that in mind, today I’m going to explore the nuclear industries in two different countries. First, we have France, which built out most of its nuclear capabilities in the 1970s. Second, I’ll look at China which is experimenting today with a range of nuclear power plant designs.

NPV and Scalability

We know. because I discuss it so often, that we need baseload power. The best example I have currently to explain this is AI data centres. They require continuous power, and so intermittent renewables are out of the window. We’re moving on from fossil fuels like coal, and so nuclear is the main option. Funny that Amazon bought a data centre powered by a nuclear power station that sits right next to it. It’s almost like this aspect of AI development is beginning to be realised, and the enormous amounts of energy that will be required.

Most analyses of nuclear power plants show that they possess a negative NPV. Even in the most optimistic of scenarios, where a nuclear plant is constructed in 5 years, there is only a small probability that NPV will be positive.

That means we’re spending more throughout the entire lifetime of a nuclear power plant than we’re earning from it. It’s an issue because if we want to pursue profitable energy projects, nuclear’s high initial costs would limit the nuclear buildout. We’re seeing many nations doing this, limiting their nuclear buildouts. Capital costs and delayed constructions are increasing debt costs associated with these projects, further increasing costs. This isn’t the entire reason for the high costs of nuclear, but it would be an area to start looking into when considering how to limit these costs.

This leads me to question nations that possess high percentages of nuclear power in their total energy portfolio. Take France, for example. Did they tolerate negative net present values in their pursuit of a clean portfolio for years, or were costs less back then? Or China, which is currently building out a large number of nuclear power plants, including generation four nuclear power plants. Do these projects possess a positive NPV?

France, Nuclear NPV, and Scaling Down To Scale Up

The French project is considered one of the most successful nuclear scale-up projects in recent memory. They now enjoy low electricity costs and export a percentage of their electricity to countries around them, namely Germany, which last year ditched nuclear entirely.

Research into this issue reveals that construction costs were large.

It also made clear that government policy and regulation can make or break the nuclear industry in a country. A half-committed effort sees cost overruns, and tight regulation increases the buildout period, also contributing to increased costs.

The fact that France’s buildout is considered one of the most successful, and truthfully so, but is still riddled with high costs, demonstrates how the nuclear industry has yet to experience its scaling-up process, or as research describes it, “the nuclear industry is undergoing a process of negative learning by doing”. This process means the more you do something, the more difficult it gets.

We scaled up nuclear in the past, but disasters such as Three Mile Island, Chornobyl, and Fukushima have seen the nuclear industry bogged down in regulation, resulting in longer build times and rising construction costs. These disasters demonstrated a dire need for transparency in the nuclear industry and more extensive safety protocols, but all three would have been avoided if not for human error. But we can’t change the past. We can change going forward. We’ve overcomplicated the nuclear industry, and as a result, it has become the least affordable energy generation method by many metrics due to high costs before operation. This negative learning-by-doing has been coupled with over-complication. We need to scale up once again, but smarter. We need factory assembly of nuclear power plants. We need modularity. We need smaller projects that have less space to run into cost overruns and delayed schedules. We have to start again. With this, we also have to develop workers within the nuclear industry. Any person who was heavily involved in the nuclear industry in the 1970s is retired. The lull in nuclear power after the three main disasters we’ve seen since then hasn’t seen knowledge transferred as effectively down through the generations. Hence, poor planning and a lower-skilled labour force won’t help in nuclear construction.

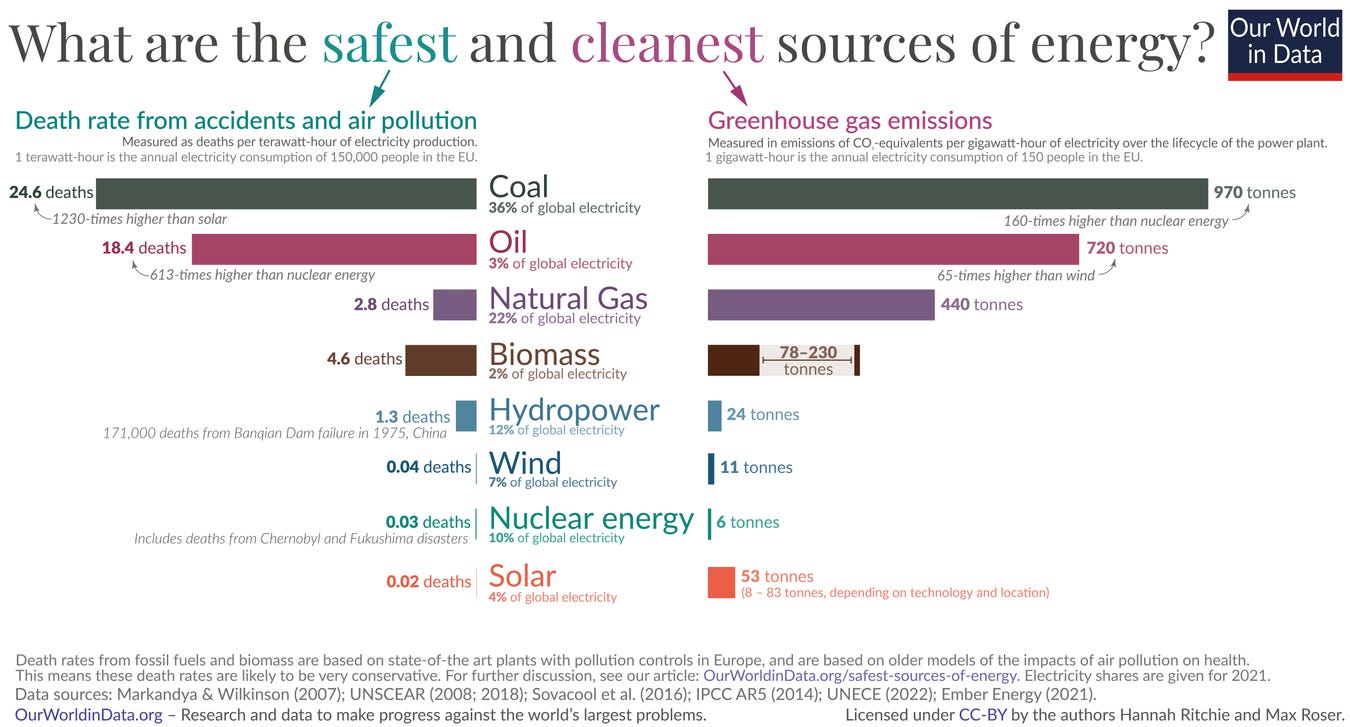

The industry also has to navigate the potential for rising prices of scarce nuclear fuels, such as uranium and thorium. It’s then that those with already established nuclear industries will reap the rewards, and those who are unprepared will scramble. One day in the future, we’ll experience wonderful innovation where uranium and thorium can be extracted from seawater economically. Until then, those who prepared decades ago stand to benefit the most, but they tolerated high costs to do so. They possess the second safest energy generation method and the cleanest when considering greenhouse gas emissions in isolation. We have shot ourselves in the foot with the nuclear industry. As we need baseload power, we find ourselves having to scale up the industry once again.

The countries who prepared took the hit of negative NPV projects in the past, so that one day, they could see everybody else suffer through the same process. Except this time, those who prepared will still have the lights on, while those who didn’t, will be sat in the dark, or paying other countries to send them the power they need.

China and Nuclear Power: Scaling Up To Scale Up

The West has soured away from nuclear. One example of these cost and time overruns is Vogtle in Georgia, USA. The project was 7 years late, and $17B over budget. Ouch. Vogtle aimed to build modules offsite and ship them onsite for cheaper construction. Construction delays saw costs rise, and Westinghouse was driven into bankruptcy, needing to be acquired by Brookfield and Cameco. It’s another example of negative learning-by-doing. They aimed too big, and the project ran away from them. They also started building with incomplete designs, unrealistic schedules, and a short supply of experienced workers.

What is China doing differently?

They have recognised that construction costs are the biggest contributor to these metrics looking unfavourable. Units constructed after 1990 were 3.5 times more expensive than the reactors in the early 1970s. They have also taken a national-level approach to their nuclear buildout.

Every plant they have built since 2010 has taken 7 years or less. These fast builds on the surface challenge the negative learning-by-doing that has plagued the West for decades. One key difference is China’s robust supply chains and access to key materials. Some call it hoarding, or weaponisation of supply chains, but they prepared for a world where supply chains could be strained, and now they’re reaping the rewards. They control the entire supply chain, and so aren’t at the whims of anybody else. This is likely a contributing factor to the Chinese constructing some nuclear power plants in less than 5 years and seeing some projects be profitable.

Even though these projects originate from a state level, the support of financing from local governments ensures these projects can get off the ground quickly. You might come at me and say, but this spending on a local level has seen these local authorities reach high levels of indebtedness. But if these projects are profitable, they are improving productivity, and spouting economic growth. A positive NPV implies this.

China’s plan could be interpreted as chaotic. But they have secured their own supply chains, built up a skilled labour base, and attempted many different designs. In a sentence, they’ve thrown enough you-know-what at the wall, and some of it has stuck.

Replicating this in Western countries is a difficult endeavour with high government debts an issue on everybody’s mind at a time when interest costs have risen sharply to tackle inflation.

But surely lessons can be learned from China’s buildout. After all, we need baseload power. We need nuclear. A place where we can look to see how a nuclear buildout will unfold in the West today is France. They plan to build 14 new nuclear power plants over the coming years. If anywhere in the West is going to build up a skilled labour force in the nuclear industry, it’s France. Through their previous experiences, they have a chance to become a supply chain leader in nuclear, just as China has done for itself.

Concluding Remarks

These affordability metrics imply that nuclear doesn’t work financially. The research papers in the sources below support this, and they’re available to explore as you wish.

The unfortunate aspect of negative NPV in nuclear is that if we want our energy transition to work, nuclear has to work. Scaling down to scale up, and the Chinese approach of securing supply chains and building a skilled labour force are methods that could be adopted to once again recognise the power of nuclear and to improve affordability metrics such as NPV and LCOE.

You could read this piece and believe I’m a fan of nuclear. Well, I am! But outside of my personal opinion, we need baseload power or sufficient storage for intermittent sources. We currently don’t have the capabilities for sufficient storage solutions to supply power during the downtime of intermittent sources. Hence we need baseload power. Does anybody want to go back to coal? Many will likely be forced to, but this isn’t cleaning up our world at all. It’s true that when fossil fuels contributed 81.5% of the world’s primary energy last year, we won’t leave them behind overnight. The best time to start pursuing alternative, reliable, baseload power was decades ago. The second best time is now. Nuclear is the baseload power method that stands the best chance of displacing other baseload power sources such as coal.

Hence why I state, regardless of the affordability, we need nuclear if we want baseload power while also cleaning up our world.

Next week, I’ll explore the internal rate of return, before moving on to return on investment.

Thanks for reading! I’d greatly appreciate it if you were to like or share this post with others! If you want more then subscribe on Substack for these posts directly to your email inbox. I research history, geopolitics, and financial markets to understand the world and the people around us. If any of my work helps you be more prepared and ease your mind, that’s great. If you like what you read please share with others.

Key Links

The Geopolitics Explained Podcast

If you want to see daily updates and discover other newsletters that suit you, download the Substack App.

You can become a paid subscriber to support my work. There are long-form monthly articles in my global questions series exclusively for paid subscribers. Read Geopolitics Explained for 20p per day or start a free trial below to find out if my work is for you! I appreciate your support!

Sources:

https://www.investopedia.com/terms/n/npv.asp

https://corporatefinanceinstitute.com/resources/valuation/net-present-value-npv/

https://hbr.org/2014/11/a-refresher-on-net-present-value

https://www.highradius.com/resources/Blog/cash-flow-from-investing-activities/

https://www.investopedia.com/terms/c/cashflowstatement.asp#:~:text=A%20cash%20flow%20statement%20is%20a%20financial%20statement%20that%20provides,investments%20during%20a%20given%20period.

https://www.investopedia.com/terms/i/inflation.asp

https://www.researchgate.net/publication/45267850_A_Net-Present_Value_Analysis_for_a_Wind_Turbine_Purchase_at_a_Small_US_College

https://corporatefinanceinstitute.com/resources/valuation/levelized-cost-of-energy-lcoe/#:~:text=The%20LCOE%20can%20be%20used%20to%20determine%20whether%20to%20move,Electricity%20Generated%20Over%20the%20Lifetime).

https://world-nuclear.org/information-library/country-profiles/countries-a-f/france#:~:text=France%20derives%20about%2070%25%20of,generation%20to%2050%25%20by%202025.

https://www.reuters.com/business/energy/frances-edf-logs-20-surge-first-half-profit-warns-about-price-declines-2024-07-26/#:~:text=It%20is%20in%20talks%20over,its%20first%2Dhalf%20earnings%20presentation.

https://montelnews.com/news/718d5f7b-5144-4bc6-aceb-2d51776fc38e/financing-issues-may-curb-french-nuclear-revival-experts

https://www.sciencedirect.com/science/article/pii/S0301421510003526

https://www.sciencedirect.com/science/article/pii/S0301421513011440

https://medium.com/geekculture/what-is-negative-learning-and-how-to-avoid-it-452d9e4c8263

https://apnews.com/article/georgia-nuclear-power-plant-vogtle-rates-costs-75c7a413cda3935dd551be9115e88a64

https://thebreakthrough.org/issues/energy/chinas-impressive-rate-of-nuclear-construction

https://x.com/Atomicrod/status/1528689000533352450

https://inis.iaea.org/collection/NCLCollectionStore/_Public/52/022/52022206.pdf

https://www.powermag.com/china-starts-construction-of-more-reactors-as-part-of-rapid-nuclear-buildout/

https://www.eia.gov/todayinenergy/detail.php?id=61927

https://www.sciencedirect.com/science/article/abs/pii/S0301421513011440